Shortly before Chinese New Year in 2024, I experienced sudden, sharp abdominal pain. Initially dismissing it as indigestion, I soon recognized the need for medical attention. I called a medical professional friend, apologising for disturbing him, but knowing that I had to act, and quickly. He swiftly advised me to head to the A&E at Farrer Park Hospital. When I limped through the doors on day one of CNY, I did not realise that my life was about to change forever.

A whirlwind of medical procedures began. I was whisked off to surgery, where I had to undergo a full hysterectomy. I was quickly diagnosed with Stage 3a Uterine cancer, which had spread to my ovary. This diagnosis necessitated a full hysterectomy followed by eight months of chemotherapy and radiation. I am now thankfully in remission.

As a financial consultant, I’ve always understood the importance of planning for the unexpected. There were so many things running through my mind when I was diagnosed – anxiety, fear, guilt, anger, and so much more. The one light in the darkness was for the financial security I’d built through the years. Having the right insurance plans in place meant I could focus on my recovery without the added stress of worrying about bills or lost income.

From my own experience, there are many important lessons that I feel I must share.

The Importance of Protection

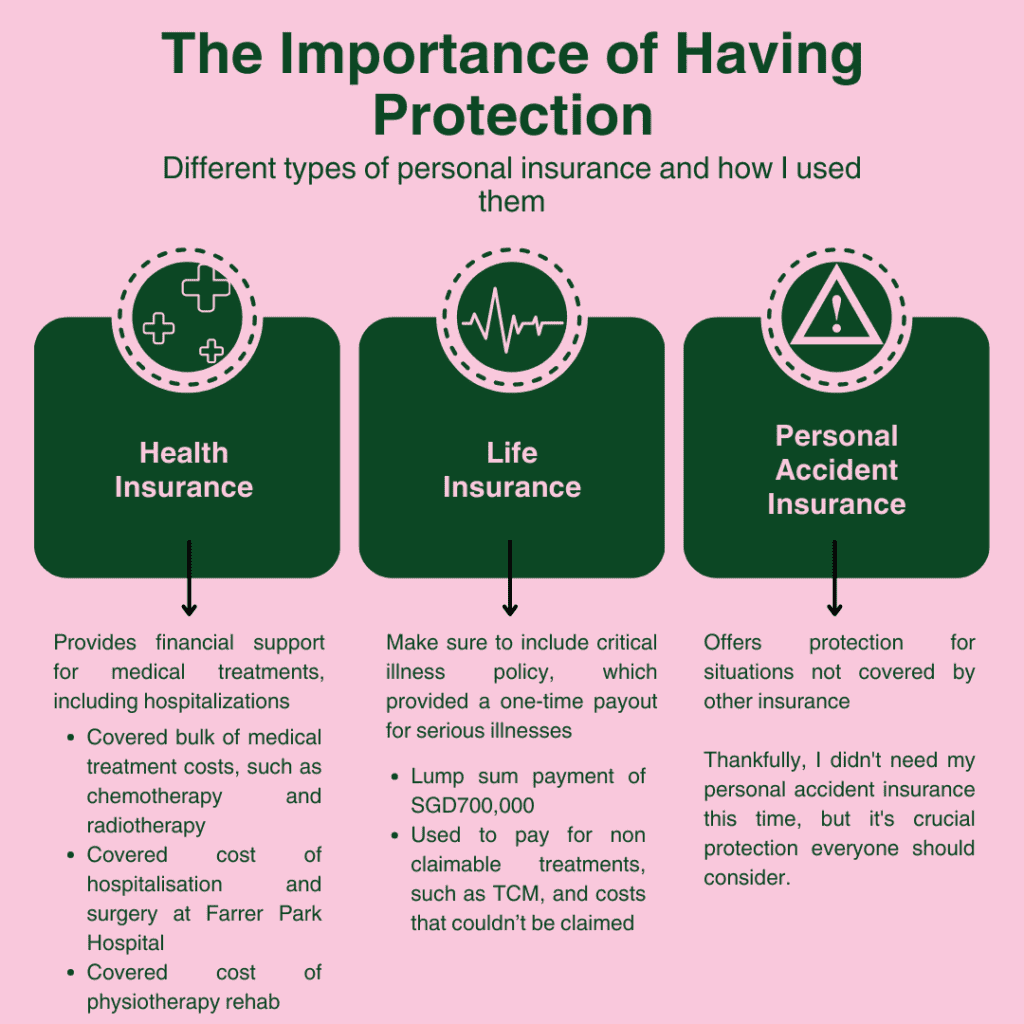

My diagnosis taught me that even the most prepared individuals can encounter unexpected challenges. Comprehensive health insurance proved vital in accessing quality care, while critical illness insurance ensured financial stability during my inability to work. This coverage facilitated hospitalization, surgery at Farrer Park, and subsequent physiotherapy and rehabilitation. The substantial lump sum from critical illness insurance (SGD 700,000) covered non-claimable expenses like Traditional Chinese Medicine and out-of-pocket costs for weekly chemotherapy (SGD 3,000 out of SGD 4,000), as well as giving me peace of mind to undergo therapy without worrying about loss of income.

Ultimately, my entire cancer treatment was financed one way or another. The chemotherapy sessions were conducted in a comfortable and dedicated setting at a private clinic, highlighting the importance of financial security in ensuring optimal care. This experience underscored the value of financial protection, as it allowed for a more comfortable and effective treatment journey.

Finding the Right Coverage

If you are someone who wants to be financially prepared for a potential health crisis, here are some key considerations:

- Health insurance: Look for a plan with a low deductible and comprehensive coverage. This will ensure you can access the necessary treatments without breaking the bank. A key benefit of good health insurance is the ability to select your preferred healthcare providers.

- Life insurance: This provides financial security for loved ones in the event of unexpected passing. Life insurance should be supplemented with critical illness coverage, ideally covering early stages. I bought my first policy when I first started work, and I had a limited budget at the time. As my income increased along the way, and especially when I started to claim for my clients, I bought more policies. This meant that I was personally able to leverage multiple life insurance policies from providers like NTUC Income, AXA (now HSBC), Tokio Marine, and Singlife to build a robust financial safety net.

- Personal accident insurance: This coverage can provide financial support in case of accidents, injuries, or disabilities. It’s advisable to consult with an insurance advisor to identify the most suitable product at each stage of your life. Fortunately I didn’t have to use it this time, but personal accident insurance is a safeguard you’ll be glad you have.

A Message of Hope

While a cancer diagnosis can be overwhelming, having the right financial support can make a significant difference. I’ve learned firsthand that even with careful planning, unexpected challenges can arise. By prioritizing comprehensive health insurance and critical illness coverage, I was able to navigate the complexities of treatment and recovery.

To be very upfront, this journey has not been smooth sailing. My body is not the same and there are days where I struggle to deal with the physical and emotional effects of the diagnosis. I could not have coped without the unwavering support of so many people and would like to take the opportunity to say:

Thank You

My heartfelt appreciation to all the medical professionals who, with their skill and dedication, helped me navigate this difficult period.

To my colleagues at finexis for standing by me in this low moment.

My family, partner and friends have been a pillar of strength for me through this tough period. Thank you for everything.

My experience has inspired me to help others navigate the financial challenges that can accompany a cancer diagnosis. I now focus on educating my clients about the importance of having adequate insurance coverage and helping them create personalized financial plans.

Life is precious. Let’s seize the day!

If my story has resonated with you and you’d like to discuss how you can make sure that you are protected from the unexpected, please don’t hesitate to reach out. Drop me a line at ten.huiyu@finexis.com.sg and let’s grab coffee.